Wharton Equity Partners has picked up six more industrial properties totaling 283,400 square feet in South Jersey, growing its presence in the market to a total of 1.3 million square feet.

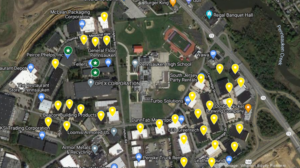

Wharton bought the properties in Cherry Hill and Pennsauken in two separate transactions. The deals highlight Wharton’s focus on buying smaller buildings as well as deals that involve sale-leasebacks as a way to grow its industrial portfolio in what has become a competitive market for investors.

“We want to aggregate another million square feet in South Jersey,” said Peter Lewis, chairman and founder of Wharton Equity. “I can do that in the next 12 to 18 months but have to stay one step ahead.”

South Jersey is experiencing unprecedented industrial demand by tenants and investors looking to get in on a hot market.

“I don’t see anything that will push rents or values backwards,” Lewis said. “You may see rents slowing but not prices.” In Pennsauken, the company bought three buildings totaling 153,400 square feet at 809 Hylton Road, 815 Hylton Road and 1045 Thomas Busch Memorial Highway in a venture with Walton Street Capital.

*Article courtesy of Philadelphia Business Journal

For more information about South Jersey industrial space for sale or lease in South Jersey or about any other South Jersey properties for sale or lease, please contact WCRE at 856-857-6300.

Wolf Commercial Real Estate, a full-service CORFAC International brokerage and advisory firm, is a premier South Jersey commercial real estate broker that provides a full range of South Jersey commercial real estate listings and services, property management services, and marketing commercial offices, medical properties, industrial properties, land properties, retail buildings and other South Jersey commercial properties for buyers, tenants, investors and sellers.

Please visit our websites for a full listing of South Jersey commercial properties for lease or sale through our South Jersey commercial real estate brokerage firm.